Have You Experienced These Trading Challenges?

Discover the common challenges many traders face. See if you can relate to any of these experiences.

-

Struggling to Control Your Emotions

- Have you ever entered a trade impulsively, knowing it wasn't the right time, only to see the market move against you? Emotional decisions often lead to poor timing.

-

Missing Out on Profitable Trades

- Do you often miss out on trades during inconvenient hours when you're not monitoring the market? It's frustrating to see perfect setups pass by.

-

Overwhelmed by the Need to Constantly Monitor the Market

- Have you missed important trading signals because you couldn't keep up with market monitoring? Balancing life while watching the charts can feel impossible.

-

Entering Trades Without a Solid Plan

- Have you opened trades without a clear strategy or risk-reward plan, only to regret it later? A lack of preparation often leads to poor execution.

-

Inconsistent Use of Margin

- Do you find yourself using inconsistent margins across trades, only to discover that your risk exposure is all over the place? This can lead to unpredictable results.

-

Questioning the Profitability of Your Strategy

- Have you ever doubted whether your trading strategy is profitable, especially after a streak of unpredictable market moves? It's natural to second-guess your approach.

-

Watching Your Profits Turn Into Losses

- Have you ever seen a trade go into profit, only to let it ride too long and turn into a loss? Knowing when to exit can make all the difference.

-

Feeling Crushed by the Pressure of Large Trades

- Do you experience overwhelming stress when handling large trades, fearing that one wrong move could lead to significant losses? This emotional pressure can cloud your judgment.

-

Frequently Getting Stopped Out

- Have you been stopped out of trades more often than you'd like, realizing your stop placement was too tight or poorly planned? Frequent stop losses can erode your confidence.

-

Struggling to Achieve Consistent Results

- Do you feel like your trading results are inconsistent, swinging from success to failure, with no clear pattern? Consistency is key, but it can be elusive.

What if you no longer need to deal with all these pain points?

Imagine trading stress-free with smarter, human-guided solutions.

A Smarter Way to Trade: Data-Driven, Human-Guided Trading System

Imagine a trading tool that keeps you in control while streamlining the execution of your strategy. With our solution, you can set up support and resistance levels, define your strategy, and let the system handle precise execution. Say goodbye to hours of chart monitoring—our tool helps you trade consistently, reduce emotional decisions, and manage risk effectively.

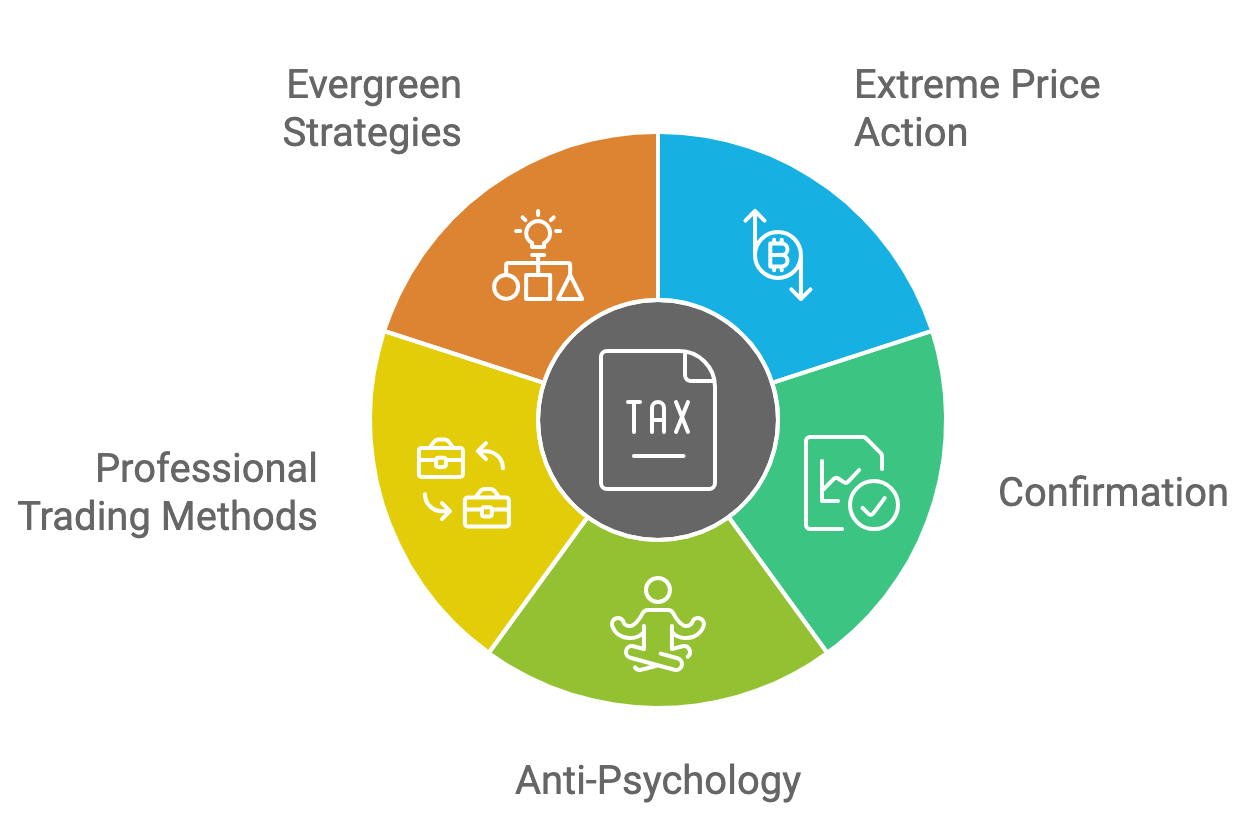

What is TraderToolsPro Based On?

TraderToolsPro is designed to equip traders with powerful tools and strategies to approach the market like a professional. Using advanced techniques like price action, confirmation, and anti-psychology methods, it helps traders gain a psychological edge and build long-term success with evergreen strategies.

How TradeToolsPro Solves These Challenges

Emotional Decisions

How We Help: Our system eliminates emotional decision-making by enabling traders to set predefined rules, ensuring trades are executed based on data and strategy, not emotions.

Missing Out on Opportunities

How We Help: Never miss a trade again. Our system’s alerting feature ensures you’re notified at the right moments, so you can confidently step away from your screen knowing your trades are covered.

Inconsistent Margin Use

How We Help: With automatic margin management, our tool calculates the optimal trade size for each opportunity based on your predefined settings, maintaining consistency and mitigating risk.

Getting Stopped Out Frequently

How We Help: By allowing you to adjust stop-loss strategies and use advanced risk-reward calculations, you can avoid unnecessary losses due to poorly placed stops.

How TraderToolsPro Works: Your Path to Consistent Trading Success

Discover how TraderToolsPro automates your strategy and helps you monitor performance.

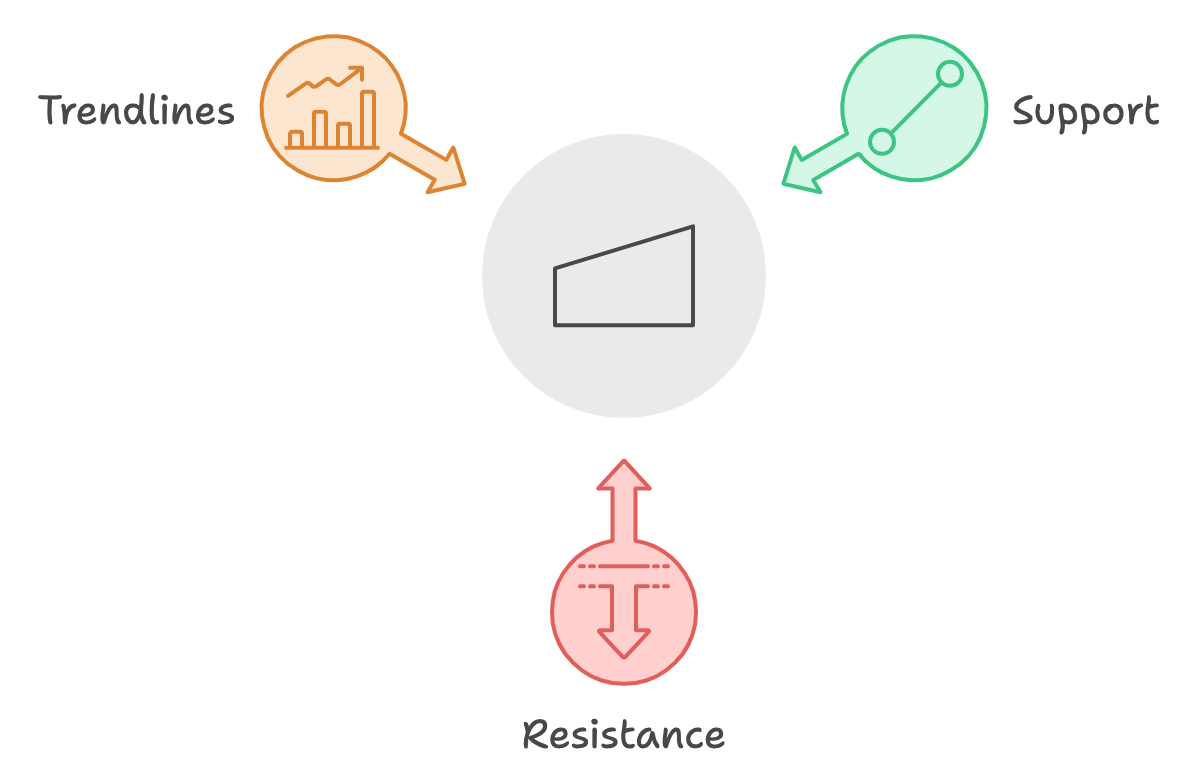

Step 1: Draw Support & Resistance or Trendlines

Set your support, resistance, and trendlines with our intuitive tools, ensuring proper entry and exit points.

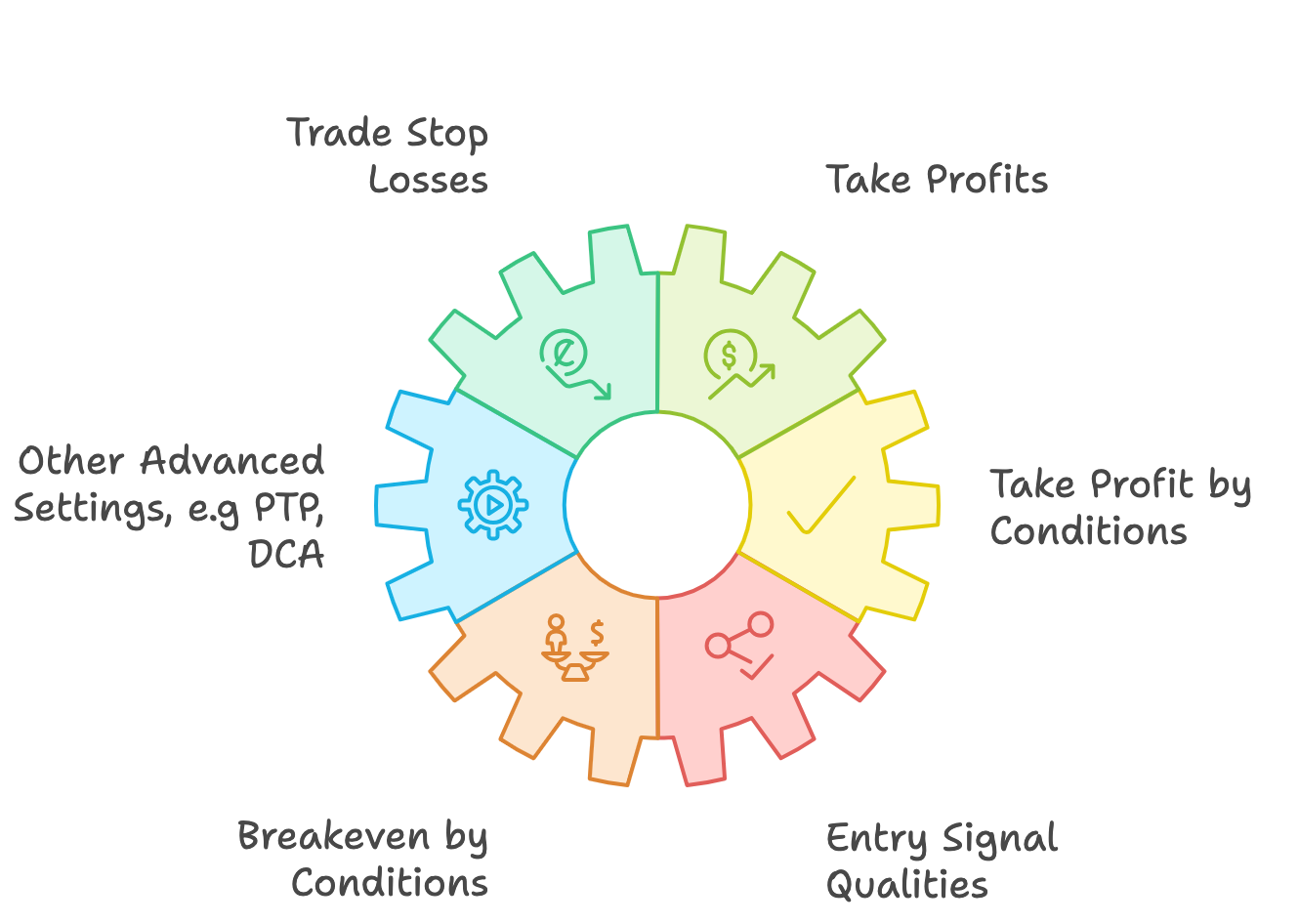

Step 2: Set Trade Parameters

Use our advanced indicator options to customize your trade entry qualities, stop losses, and take profits and advanced settings such as take profit and breakeven by conditions.

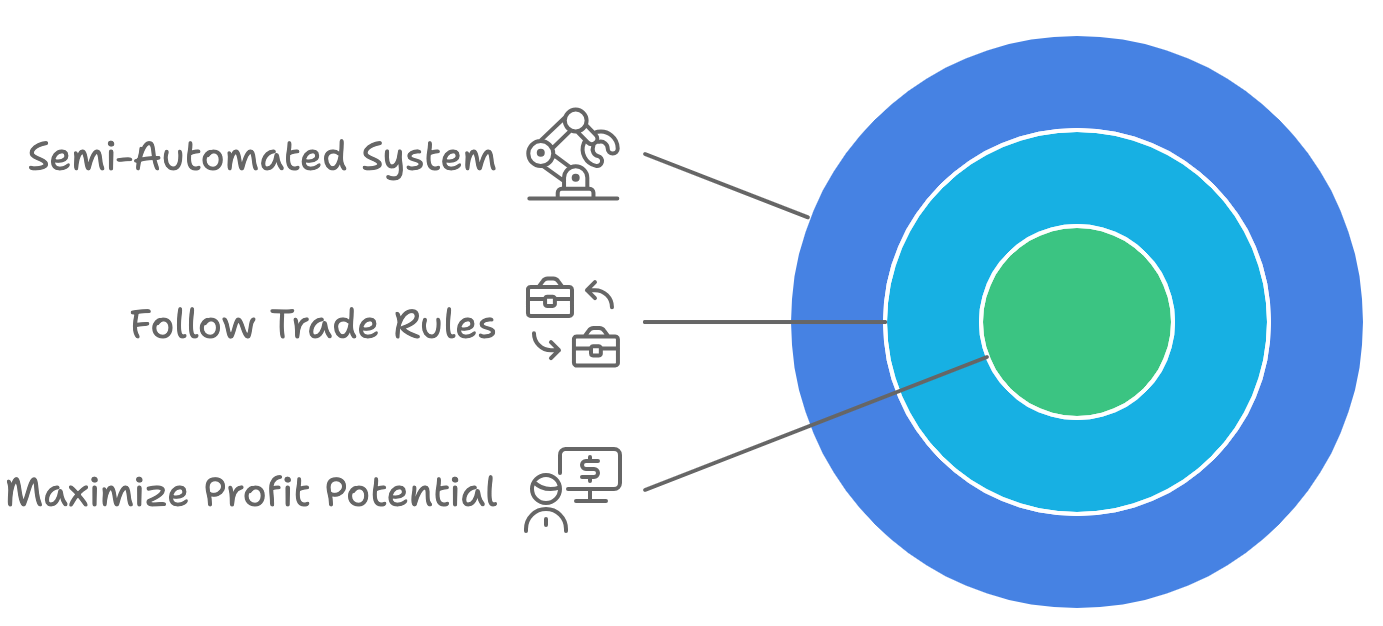

Step 3: Let the System Do the Work

The system ensures your trades align with your predefined rules, optimizing precision and maximizing your profit potential.

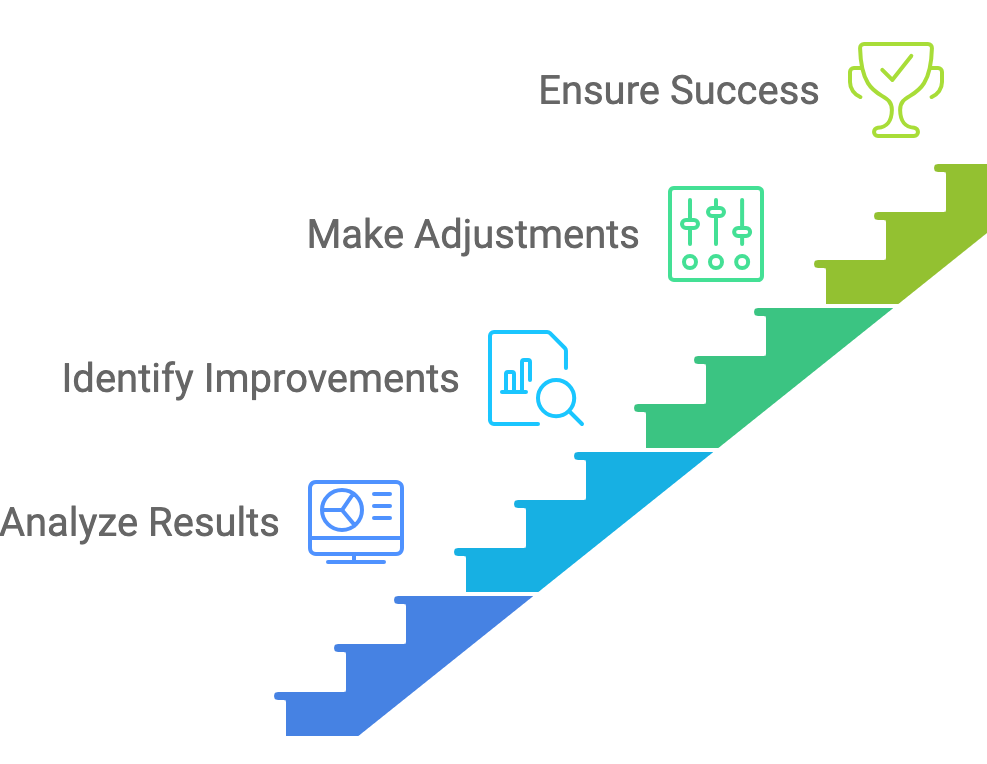

Step 4: Review Trade Results and Optimize Strategy

Use your trade results to analyze trade performance and make adjustments where necessary, ensuring continued success.

What Our Users Are Saying

Discover how TradeToolsPro has helped traders overcome their challenges and achieve consistent results.

Dansonn

"I successfully developed my own scalping strategy and achieved a 10x return in just two months using signals from TraderToolsPro."

Jason

"After trading with TraderToolsPro for 3 months, I've gained the confidence to apply for FTMO."

Jerry

"I’ve been profitable for the second consecutive month since I started using TraderToolsPro."

Why TraderToolsPro Over Other Alternatives?

Here is a key differences on why TraderToolsPro stands up as the perfect solution for traders who are looking into consistent profits. For more information you can checkout in depth comparison of TraderToolsPro vs Manual Trading and TraderToolsPro vs AI/Robot Trading

Manual Trading

- Take years to be consistent

- Exponential Growth with Proper Stop Loss

- Emotionally driven

- Missed trades due to inability to monitor

- Hard to get good risk reward

TradeToolsPro

- Easy To Get Consistent

- Involved Manual Works

- Exponential Growth with Proper Stop Loss

- Evergreen, price-action-based strategies

- Advanced Risk Management Features

- Crazy Risk Reward Etc

Auto Trading Bots

- No manual work

- Unpredictable Trend , Unable to earn consistent

- Exponential Growth but risk of whole wallet

Become a Professional Trader in Months – Without Years of Learning!.

"Fast-track your trading skills and go pro in just 60 days with our proven system. No more wasted time!."

Start My Transformation!